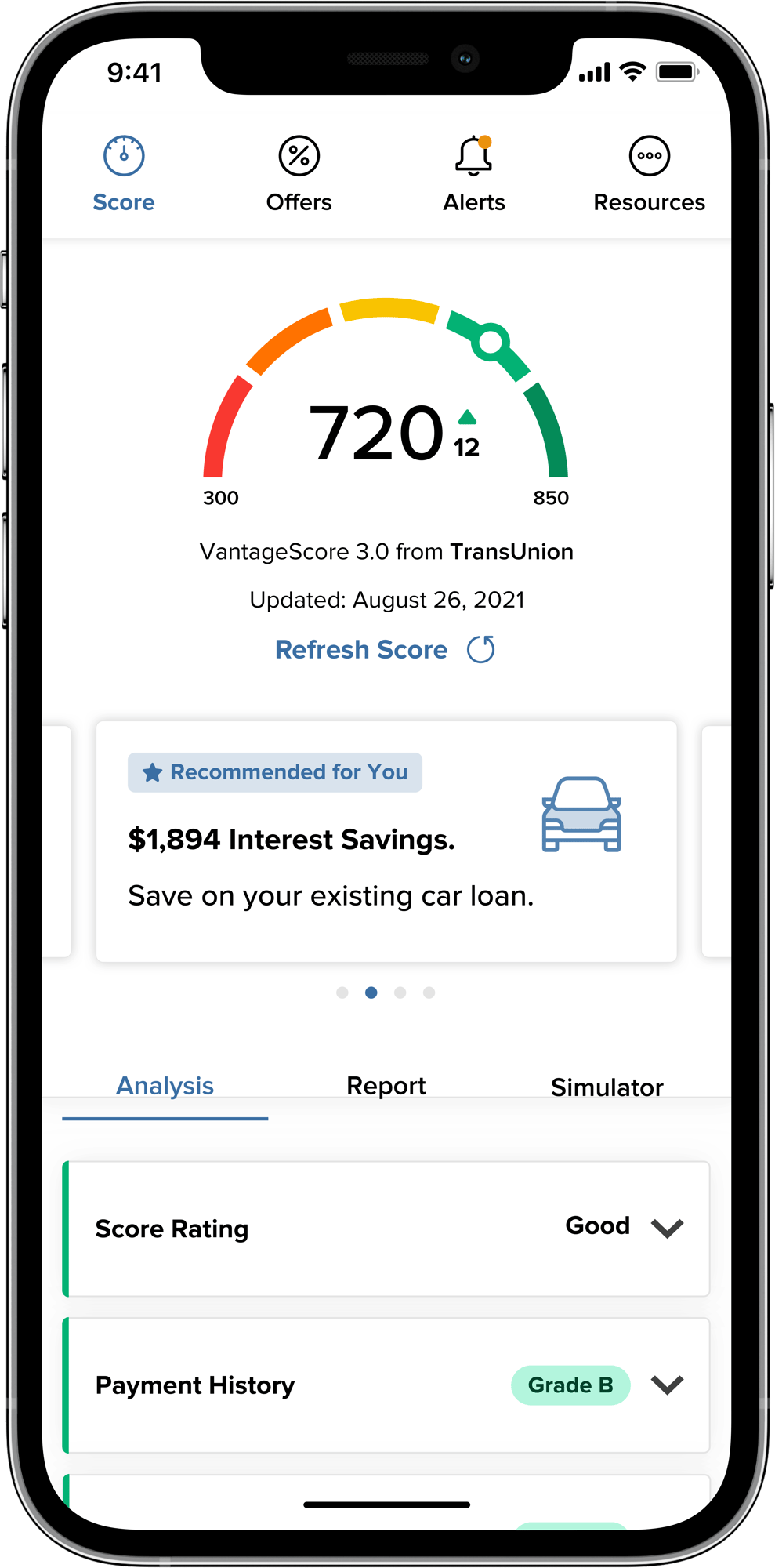

SavvyMoney

Your Credit Score and More

Staying on top of your credit has never been easier. With City & County Credit Union’s FREE credit score tool – SavvyMoney, you can access your credit score, full credit report, credit monitoring, financial tips & so much more! You can do all of this anytime and anywhere, without impacting your score.

SavvyMoney Credit Score Includes

- Free access to credit score, full credit report, and credit monitoring

- Ability to check credit score daily without it being affected

- Weekly credit score updates

- Available within the CCCU mobile app or online banking

- Money-saving offers

- Credit Score Action Plan

- Financial Checkup – quick assessment on household spending, financial planning and monthly budget

View Your Score in Mobile & Online Banking

To get started with SavvyMoney, simply log in to your mobile app or online banking to view your score.

If you have yet to enroll in mobile or online banking, follow our quick enrollment options to get started.

Frequently Asked Questions

The score that is provided in SavvyMoney is not the FICO score, but it will be close to your FICO score. Both scores use consumer credit data to generate a credit score, but they use different methods to calculate the score. This may result in slight scoring differences. The two scoring models are FICO and VantageScore. SavvyMoney uses VantageScore.

Credit scores are updated weekly. You will receive an email from SavvyMoney every time your score has been updated. You are able to opt out from receiving these emails at any time.

There are five categories used to calculate your score and each has a different weight in making up your credit score.

- 41% Payment History

- 22% Credit Usage

- 20% Length of Credit History

- 11% Inquiries

- 6% Account Mix

No. You are able to check your credit score daily or as often as you would like without it affecting your score. Checking your credit score in SavvyMoney is considered a soft inquiry, which does not affect it.

Members will be eligible to use SavvyMoney if they are 18 or older. If a member hasn’t borrowed before, or has a very thin file, either a low credit score will be shown or no score at all. They are still 100% eligible to opt in and can use SavvyMoney as a financial education tool.

The score displayed in digital banking is for the primary individual on the membership only.